Featured

Table of Contents

Customers that register in the AMP program are not eligible for installation plans. Internet Power Metering (NEM), Straight Gain Access To (DA), and master metered consumers are not presently eligible. For clients preparing on moving within the following 60 days, please use to AMP after you've developed solution at your brand-new move-in address.

One crucial aspect of financial obligation mercy relates to tax standing. The general regulation for the Internal revenue service is that forgiven financial debt earnings is taxed.

The PSLF program is for borrowers that are utilized permanent in qualifying public service work. You would need to be eligible when you have actually made 120 certifying settlements under a certifying settlement plan while benefiting a certifying employer. As soon as you have fulfilled this requirement, the equilibrium on your Straight Finances is forgiven.

The 20-Second Trick For Support Provided From Certified Counselors

This is to motivate instructors to offer in locations where they are most required. IDR plans to change your regular monthly student finance payment quantity based on revenue and household dimension. Any type of outstanding balance is forgiven after 20 or 25 years of eligible payments, depending on the specific chosen actual plan.

The CARES Act suspended funding payments and set interest prices at 0% for qualified federal pupil finances. Personal student finances can not be forgiven under the government car loan mercy programs since they are provided by private loan providers and do not bring the support of the federal government.

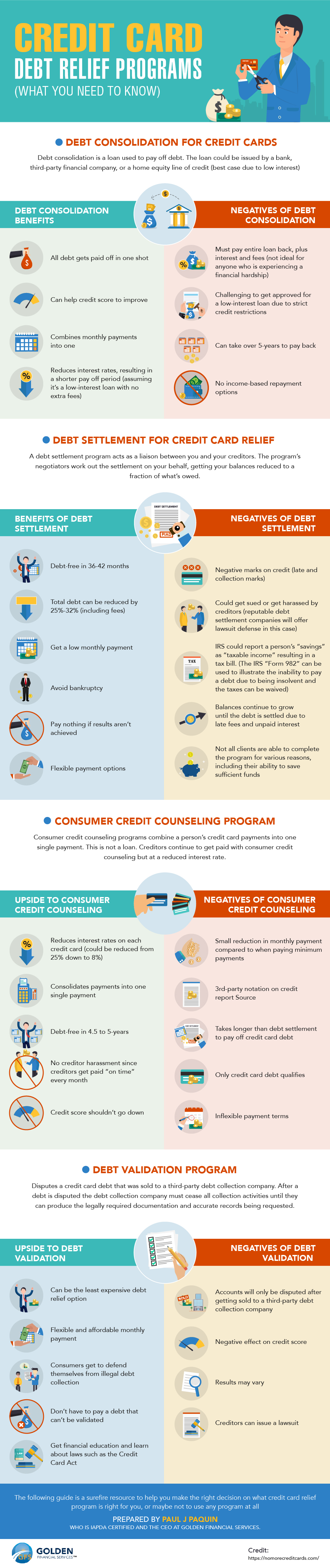

Refinancing: In some cases, a consumer takes out a brand-new lending with much better terms to pay off existing financings. Paying off may entail a reduced rates of interest or more convenient regular monthly payments. Debt consolidation: combines several finances right into one, making the payment less complex. Great debt is required, so not all customers might certify.

Restoring Personal Financial Standing the Strategic Way Can Be Fun For Anyone

Some exclusive lending institutions supply case-by-case difficulty programs. These consist of momentarily making interest-only payments, briefly reducing settlements listed below the contract price, and even various other forms of accommodations. Borrow versus those assets, like cash worth from a life insurance policy policy, or take car loans from family members and friends. Such alleviation is, nevertheless, short-term in nature and includes its very own set of threats that must be very carefully weighed.

Some of the financial debts forgiven, especially derived from debt negotiation, likewise negatively effect credit rating scores. Frequently, the argument concerning financial obligation forgiveness concentrates on its lasting results.

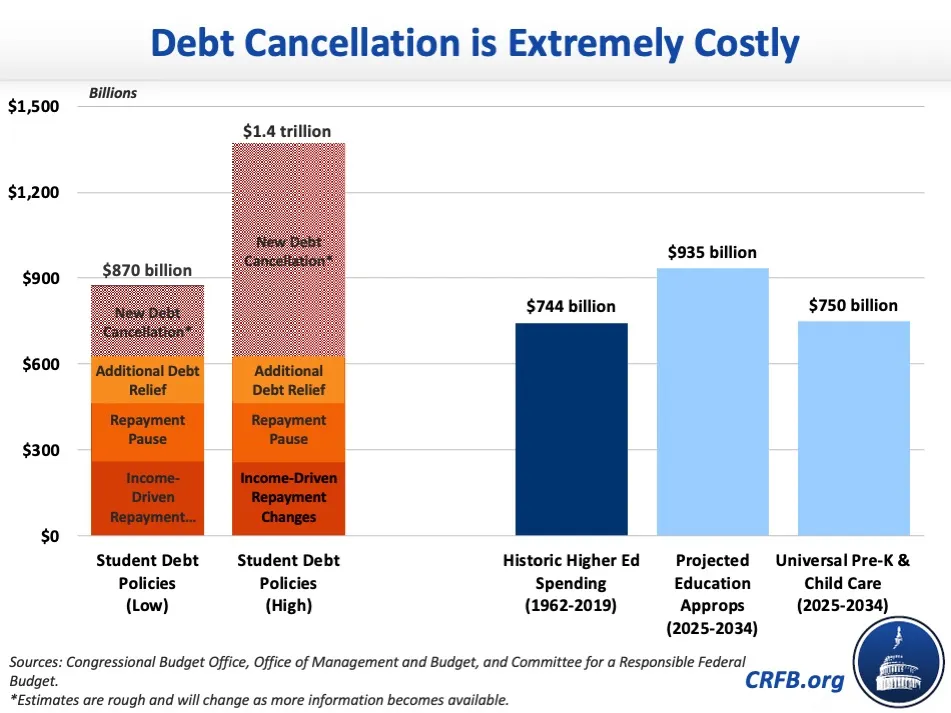

Mercy of big quantities of debt can have significant financial implications. It can include to the national financial debt or necessitate reallocation of funds from various other programs.

Understand that your finances may be strictly government, strictly exclusive, or a combination of both, and this will certainly factor right into your options. Forgiveness or settlement programs can quickly straighten with your long-lasting economic objectives, whether you're buying a residence or preparation for retired life. Recognize just how the various types of financial obligation alleviation may influence your credit rating and, later on, future loaning ability.

What Does The Advantages and Disadvantages When Considering Debt Forgiveness Mean?

Provided the potential tax effects, seeking advice from a tax obligation expert is recommended. Financial obligation forgiveness programs can be an actual lifesaver, however they're not the only way to take on placing financial obligation. These plans readjust your government pupil finance repayments based on your income and family size. They can reduce your monthly settlements currently and might forgive your continuing to be financial obligation later.

Two methods to pay off financial obligation are the Snowball and Avalanche techniques. Both aid you focus on one debt at a time: Pay off your tiniest debts.

Before choosing, consider your very own cash situation and future plans. It's wise to find out about all your options and speak to a cash professional. This means, you can make choices that will help your funds over time. Internal Earnings Service. (2022 ). Canceled Financial Obligations, Repossessions, Repossessions, and Abandonments (for Individuals).

Unlike financial obligation consolidation, which combines multiple financial debts into a single finance, or a debt monitoring strategy, which reorganizes your settlement terms, financial obligation forgiveness straight reduces the major balance owed. The continuing to be balance is then forgiven. You might pick to discuss a negotiation on your very own or employ the assistance of a debt settlement business or a seasoned financial obligation help attorney.

Not simply any individual can get charge card debt mercy. You typically need to be in dire monetary straits for lenders to even consider it. Specifically, financial institutions take a look at various elements when considering financial obligation mercy, including your earnings, properties, other financial obligations, capacity to pay, and desire to cooperate.

Rumored Buzz on Developing a Personalized Financial Recovery Plan

In some cases, you may be able to resolve your financial obligation scenario without resorting to bankruptcy. Prioritize vital expenses to boost your financial situation and make room for financial obligation settlements.

Latest Posts

4 Simple Techniques For Actionable Advice to Restore Your Credit

The 6-Minute Rule for Bankruptcy Basics and Qualifications

All about Actionable Advice to Restore Your Credit